Revolutionary technology but at the expense of the environment

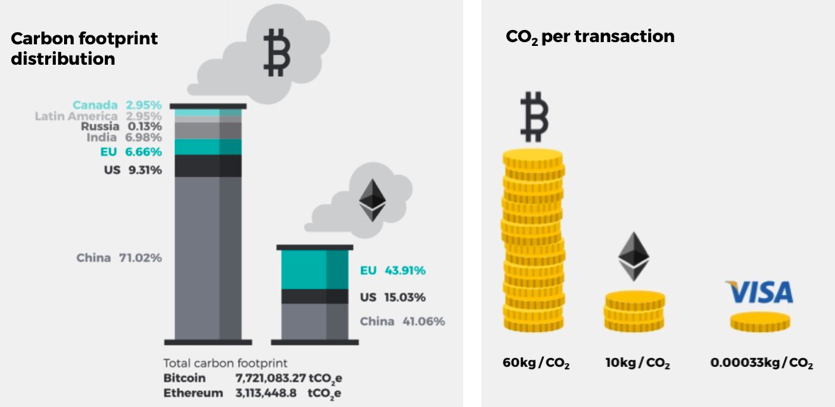

Did you know that each bitcoin transaction in Crazy Time game requires the same amount of energy used to power nine homes in the US for a day? Or that each Bitcoin and Ethereum transaction emits 60kg and 10kg of carbon dioxide respectively. These compared to just 0.3grams of carbon dioxide being emitted for each VISA transaction*.

Bitcoin mining and the environment

*Based on data collected on: October 24, 2017 by South Pole Group as part of the Climate Ledger Initiative.

While Bitcoin and Ethereum have enabled us to perform tasks and create a trustless environment

for many practices today, it has been at a cost.

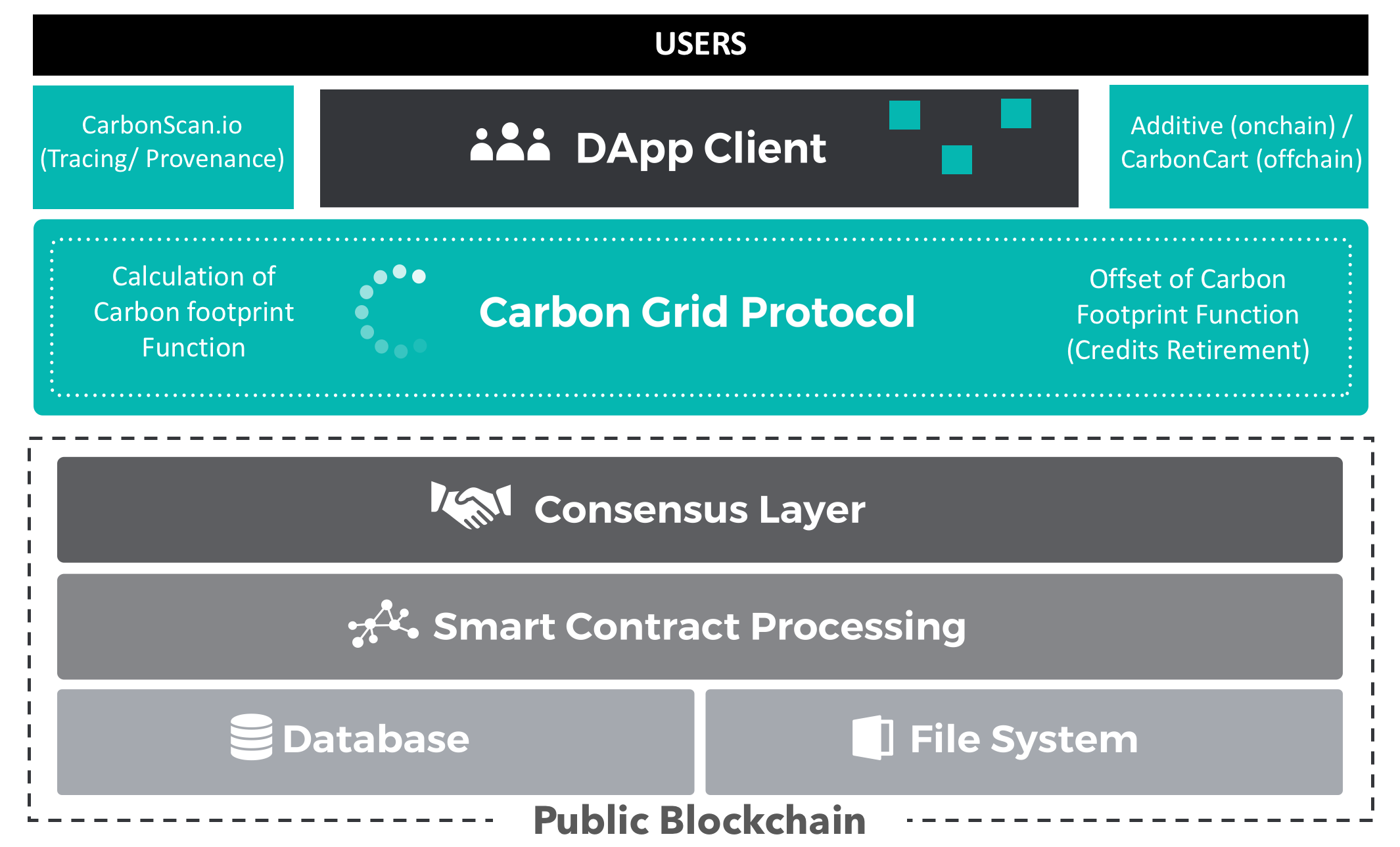

Carbon Grid Protocol will help solve this problem by introducing

tradable carbon credits backed by crypto-economic incentives to the blockchain ecosystem